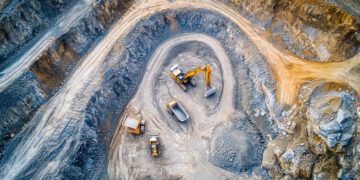

Mining Industry’s Push for Decarbonization and Digital Transformation

The metals and mining sector is rapidly advancing towards decarbonization and digital transformation, with 55% of industry leaders focusing on reducing emissions, according to a recent KPMG survey.

The 2024 Global Metals and Mining Outlook by KPMG highlights that 47% of industry executives see technology investments as crucial for transforming carbon footprints in the coming years.

This report, which includes insights from over 450 C-level executives, underscores the sector’s shift driven by sustainability, tech advancements, and strategic supply chain changes.

Sammy Ahmed from KPMG emphasized that the sector is at a crucial point where sustainability and technology are key to achieving resilience and growth. He noted the importance of integrating sustainable practices for a net-zero future.

Artificial intelligence is identified by 43% of the executives as a vital tool for tackling strategic challenges, such as optimizing production and reducing emissions. Bob Wilt, CEO of Ma’aden, noted that AI and advanced analytics have significantly reduced the time required to commission new mines.

As companies work to lower emissions and enhance efficiency, initiatives like electrifying mining machinery are proving beneficial both environmentally and economically. Moreover, 43% of firms are already using systems to monitor carbon footprints.

Farhan Muhammad from KPMG Saudi Arabia highlighted that global trends in AI and innovation are being adopted locally, showing promising results in decarbonization and operational efficiency.

Despite challenges like price volatility and supply chain disruptions, the industry remains optimistic. KPMG reports that 66% of executives have noticed increased output price volatility due to geopolitical factors, yet 61% are confident about growth potential.

The sector faces a tech skills gap, with 47% of leaders citing a shortage in skilled talent. Companies are addressing this through upskilling and partnerships with educational institutions to attract tech and renewable energy talents.

Regarding regulatory concerns, 33% of executives view Scope 1 and 2 emissions as significant risks, with 30% concerned about Scope 3. AI is increasingly used to predict regulatory changes, with 56% of executives acknowledging its role in managing compliance risks.