Saudi Arabia, renowned as the top global oil exporter, is now venturing into lithium production investments in Latin America. This strategic move aligns with the nation’s ambition to become a prominent force in the electric vehicle (EV) manufacturing arena.

Bandar Alkhorayef, Saudi Minister of Industry and Mineral Resources, plans to visit Chile, home to the world’s most extensive lithium reserves, in July for discussions in the capital, Santiago, as reported by Reuters.

Earlier this year, Alkhorayef expressed Saudi Arabia’s interest in foreign lithium sources to Reuters, highlighting the country’s goal to break into the EV market.

The Saudi foray into lithium is happening amidst China’s dominance in processing lithium, cobalt, and rare earth elements, as countries worldwide strive to diversify their supply chains for these critical minerals.

Market analysts see a “strong possibility” of a lithium supply deal between Saudi Arabia and Chile, according to discussions with The National.

There are several necessary steps before Saudi Arabia could harness this resource for EV battery production, as highlighted by Mehdi Ali, co-founder of Woodcross Capital. Ali suggests that the kingdom might not just secure raw lithium but potentially establish a complete EV battery production chain.

Riyadh is channeling billions into becoming an EV hub, aiming to compete with leading auto markets such as the US and China and shifting away from oil dependency. Investments include $10 billion in Lucid Motors, the launch of electric car brand Ceer, and the construction of an EV metals plant.

In 2023, EV sales approached 14 million units, with China, Europe, and the US accounting for 95% of these sales, as per the IEA. China alone registered 8.1 million new electric car registrations, followed by the US with 1.4 million and Europe with approximately 3.2 million.

Robin Mills, CEO of Qamar Energy, mentioned that shipping lithium to Saudi Arabia for domestic EV use might not be necessary. Vertical integration within the supply chain could provide an economic hedge and better control over pricing, which lacks transparency.

After a surge, critical mineral prices plummeted in 2023, returning to pre-pandemic levels, with lithium prices falling by 75%, according to an IEA report.

Mills emphasizes the importance of having a stake in the supply chain for better margins and supply predictability in the battery sector.

Beyond lithium, Saudi Arabia has been actively pursuing mining and mineral assets in Latin America. Last year, a Saudi joint venture acquired a significant stake in Brazilian mining leader Vale. Meanwhile, the UAE is also investing in critical metals, including a substantial ownership in Zambia’s Mopani Copper Mines.

Both nations aim to develop expertise and human capital to grow their mineral sectors. Saudi Arabia, looking to substantially increase mining’s contribution to its GDP by 2030, has found notable deposits of various metals through exploration.

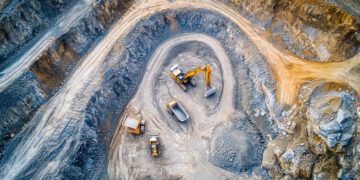

Chile’s lithium reserves span over 60 salt flats in the Atacama Desert. Currently, only two companies produce lithium in Chile, and despite having the largest reserves, Chile is second to Australia in production levels.

With these strategic moves, Saudi Arabia is positioning itself within international supply chains and potentially gaining access to processed lithium for its burgeoning EV industry.

Amid US-China tensions over critical minerals, Saudi Arabia’s interest in this sector marks a significant development. With China’s dominance in critical mineral production and the West’s efforts to close this gap, Saudi Arabia’s investments in lithium reflect a broader strategy to ensure its place in the future of global energy and manufacturing.