Almasane Alkobra Mining Co. (AMAK), a leader in Saudi Arabia’s mining sector and notable for producing zinc, copper, gold, and silver, has reported impressive financial results. For the period ending September 2024, net profit surged by 181% to SR137 million ($36.4 million), compared to SR49 million the previous year.

The company’s growth is largely due to a significant 108% increase in gross profit, reaching SR198 million. This was fueled by higher prices and increased sales of copper and zinc. Additionally, reduced financing costs and improved operational efficiencies contributed to this strong financial performance.

Key Financial Highlights (ending Sept. 30):

- Revenue: SR554 million, a 48% increase from SR373 million last year.

- Gross Income: SR198 million, up 108% from SR95 million.

- Operating Income: SR149 million, a 183% rise from SR53 million.

- Net Income: SR137 million, a 181% increase from SR49 million.

- Earnings Per Share: SR1.55, up from SR0.55.

CEO Geoffery Day emphasized AMAK’s resilience and strategic focus, stating, With our new growth strategy, we are confident that 2024 will be a record year for AMAK.

Shareholders’ equity reached SR1.2 billion, underscoring the company’s commitment to enhancing its financial health and shareholder value.

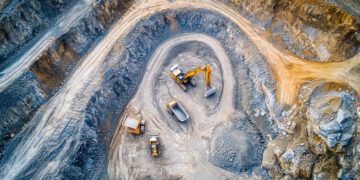

AMAK’s robust performance in Q3 and throughout 2024 highlights its strategic focus on production growth and operational efficiency. The company has unveiled a growth strategy to expand production capacity and strengthen its mining industry presence. Central to this is the expansion of its processing plant, anticipated to significantly increase output.

These efforts, alongside new leadership appointments, position AMAK to leverage favorable market conditions, deliver sustained shareholder value, and contribute to the development of Saudi Arabia’s mining sector in line with Vision 2030.