In a significant stride towards economic enhancement, Saudi Arabia’s Minister of Industry and Mineral Resources, Bandar Alkhorayef, alongside Vice-Minister for Mining Affairs, Khalid Al-Mudaifer, are gearing up for a strategic visit to Brazil and Chile. Their mission is to foster stronger bilateral partnerships, draw investments to Saudi Arabia, and uncover avenues for reciprocal benefits in the realms of minerals and industry.

The visit, spanning from July 22-30, will see the Saudi delegation traversing key Brazilian cities such as São Paulo, Brasília, and Rio de Janeiro, before heading to Santiago in Chile. This diplomatic endeavor is in sync with Saudi Arabia’s Vision 2030, which aims at diversifying the nation’s economic landscape and carving a niche as a powerhouse in industry and economics.

The tour agenda includes high-level dialogues with senior officials from various ministries in both countries, as well as interactions with top-tier global entities in the sectors of mining, food processing, and aviation, among others.

In Brazil, the delegation has planned engagements with the Brazilian Mining Association (IBRAM), Vale, Minerva Foods, JBS, and BRF SA. In Chile, meetings with the Minister of Mining and leaders from The Federation of Chilean Industry (SOFOFA), in addition to industry titans Codelco and Antofagasta, are on the itinerary.

Brazil and Chile boast of extensive mineral wealth and have been important partners for Saudi Arabia. Brazil’s partnership has been particularly strong, focusing on energy, minerals, agricultural produce, and fertilizers.

Currently, Saudi investments in Brazil are noteworthy, with a 10% interest in Vale Base Metals through Manara Minerals—a joint venture between the Public Investment Fund (PIF) and Ma’aden—and a 10.7% holding in BRF by the Saudi Agricultural and Livestock Investment Co. (SALIC).

Chile’s ranking as the second-largest lithium producer opens doors for potential cooperation in electric vehicle production and renewable energy sectors. The Saudis are poised to explore avenues for knowledge-sharing and technical collaborations. Almar Water Solutions, a subsidiary of the Saudi Abdul Latif Jameel Group, has already shown interest in Codelco’s Maricunga lithium project set for kickoff in June 2024.

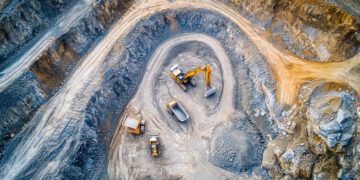

The Kingdom’s rich geological resources, backed by 80 years of data, make it an appealing prospect for investors. The recently updated estimates have almost doubled the value of Saudi Arabia’s mineral reserves to $2.5 trillion.

Further bolstering investor confidence is the Mining Investment Law of 2019, which has elevated Saudi Arabia’s status in the mining domain, as reflected in the Mining Journal World Risk Report 2023. The country has been acclaimed for its minimized legal and financial risks and streamlined permitting processes.

New incentives introduced by the law include 75% co-funding for capital expenditures, a five-year hiatus on royalty fees, discounts for domestic processing, a 20% corporate tax rate, and provisions for complete foreign ownership. Additionally, the Exploration Enablement Program (EEP), launched in April 2024 with a $182 million budget, is designed to mitigate investment risks and hasten exploration while nurturing local expertise in the sector.

Saudi Arabia is strategically positioned, with a young workforce, robust infrastructure, and alluring investment incentives, to be a premier destination for investment. The anticipated outcomes from the visits to Brazil and Chile are set to fortify bilateral ties and boost mutual prosperity through investment, sustainable development, and diversification in the mining and industrial sectors.