Saudi Arabian Mining Co. (Maaden) has successfully raised $1.25 billion through its first Islamic bond sale. This significant financial move is aimed at supporting a major expansion over the next five years.

Investor interest was high, with offers exceeding $10 billion for the sukuk. The bonds were divided into $750 million maturing in 2030 and $500 million maturing in 2035.

According to Maaden CEO Bob Wilt, the strong market appetite highlights the untapped potential in Saudi Arabia’s mining sector. Approximately half of the demand originated from US investors, with the remainder split across Europe, Asia, and the Middle East.

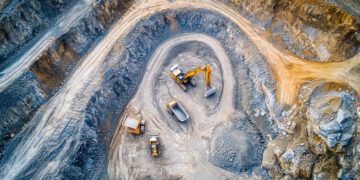

The company is embarking on an ambitious investment plan exceeding $12 billion, focusing on expanding its gold, phosphate, and aluminum operations, as well as exploring copper resources. A decision on new investments is expected mid-year.

While Maaden doesn’t anticipate returning to the bond market soon, future fundraising may occur to support further growth initiatives. As a key player in Saudi Arabia’s strategy to diversify its economy, Maaden is crucial to establishing mining as a third economic pillar alongside oil and petrochemicals.

In January, Maaden announced plans to form a joint venture with Saudi Aramco to explore and mine energy transition metals, aligning with the nation’s broader economic goals.