The Saudi Export-Import Bank (Saudi EXIM) has finalized a $300 million credit facility agreement with Glencore, a leading global commodity firm. This strategic move is designed to bolster Saudi Arabia’s non-oil exports, enabling them to reach over 156 international markets. The signing took place with H.E. Khalid bin Saleh Al-Mudaifer, Vice Minister for Mining Affairs, present.

Saudi EXIM’s CEO, H.E. Eng. Saad bin Abdulaziz Al-Khalb, and Glencore’s Jyothish George, Head of Copper Marketing, formalized the agreement during a Geneva roundtable. The event, named “Saudi Arabia: A Crossroads for International Trade in Goods,” attracted global financial leaders, aiming to draw export investments into Saudi Arabia.

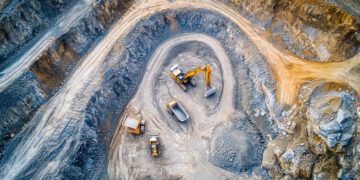

Under this agreement, Saudi EXIM will finance Glencore to boost its purchase and international marketing of minerals from Saudi Arabia, thus enhancing the global reach of Saudi mineral exports.

Eng. Saad Al-Khalb remarked that this initiative supports Saudi Vision 2030 and the National Industrial Strategy, positioning Saudi Arabia as a key player in global mineral production. He emphasized the bank’s role in fostering a robust investment environment in the mining sector, leveraging the Kingdom’s rich mineral resources.

Jyothish George expressed enthusiasm for the partnership, acknowledging Saudi Arabia’s crucial contribution to the supply of essential minerals. He highlighted Glencore’s commitment to advancing Saudi Vision 2030 objectives through its global network.

About Saudi EXIM: The bank is pivotal in realizing Saudi Vision 2030’s goals by enhancing the non-oil economy through financing, guarantees, and credit insurance, boosting the competitiveness of Saudi products worldwide.

About Glencore: As a leading global natural resource company, Glencore produces and markets over 60 commodities, supporting both decarbonization and current energy demands through its extensive global network.